How to Start a Business in 2026:Setup and Monthly Compliance Guide 📊

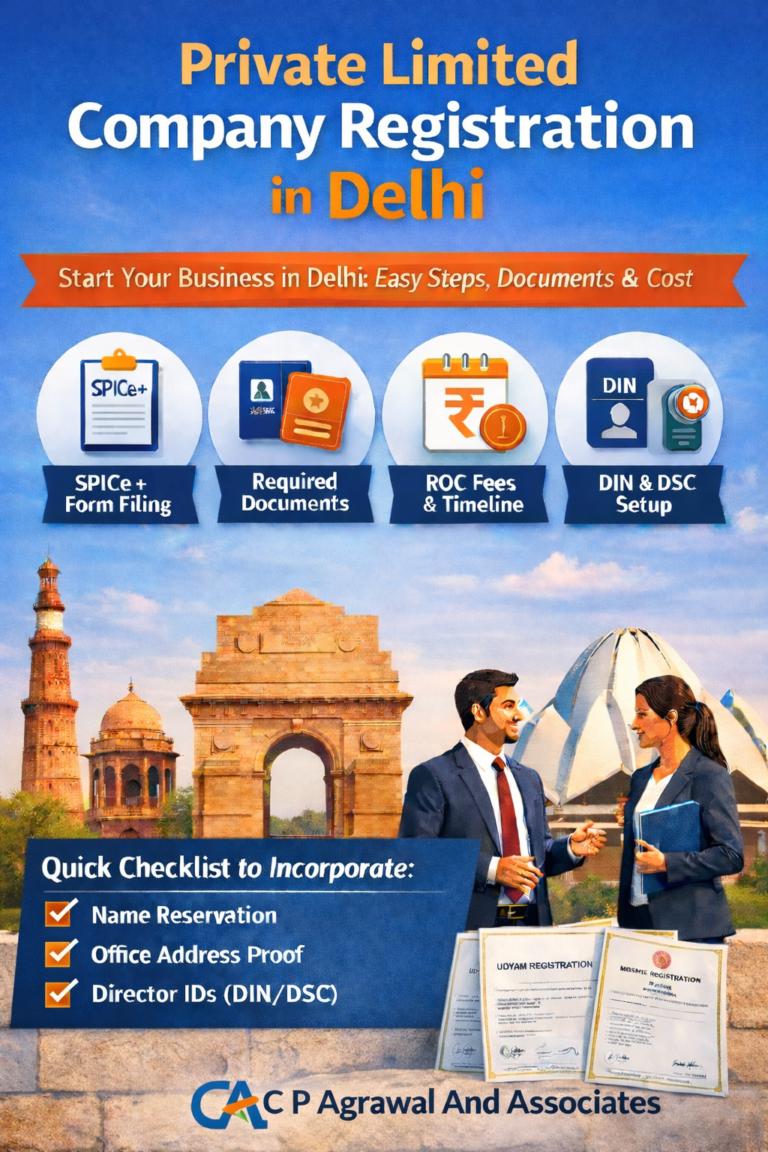

Starting a business in 2026 requires more than registration—it requires a structured compliance framework aligned with GST, Income Tax, TDS, PF/ESI, and digital reporting systems. Regulatory platforms are now interconnected, and mismatches are automatically flagged. This guide explains: Why compliance…