What is company registration (short answer) ✅

Company registration (commonly incorporation of a Private Limited company in India) is the legal process of creating a separate legal entity under the Companies Act — you file an integrated web form (SPICe+ / INC-32) with the Ministry of Corporate Affairs (MCA) to get the company incorporated, obtain DINs (if needed), and apply for PAN/TAN in the same flow.

Company types you’ll typically consider in Delhi — quick overview 🧾

-

Private Limited Company — best if you want outside investors, limited liability, and a formal corporate structure.

-

LLP (Limited Liability Partnership) — lighter compliance, good for professional services.

-

One Person Company (OPC) — for single founders who want corporate benefits without co-founders.

Choose by ownership needs, funding plans and compliance appetite.

Who should register a Private Limited in Delhi? ⚖️

-

Founders planning to raise capital or scale beyond a small team.

-

Startups expecting B2B contracts that insist on corporate status.

-

Businesses that want limited liability and easier equity transfers.

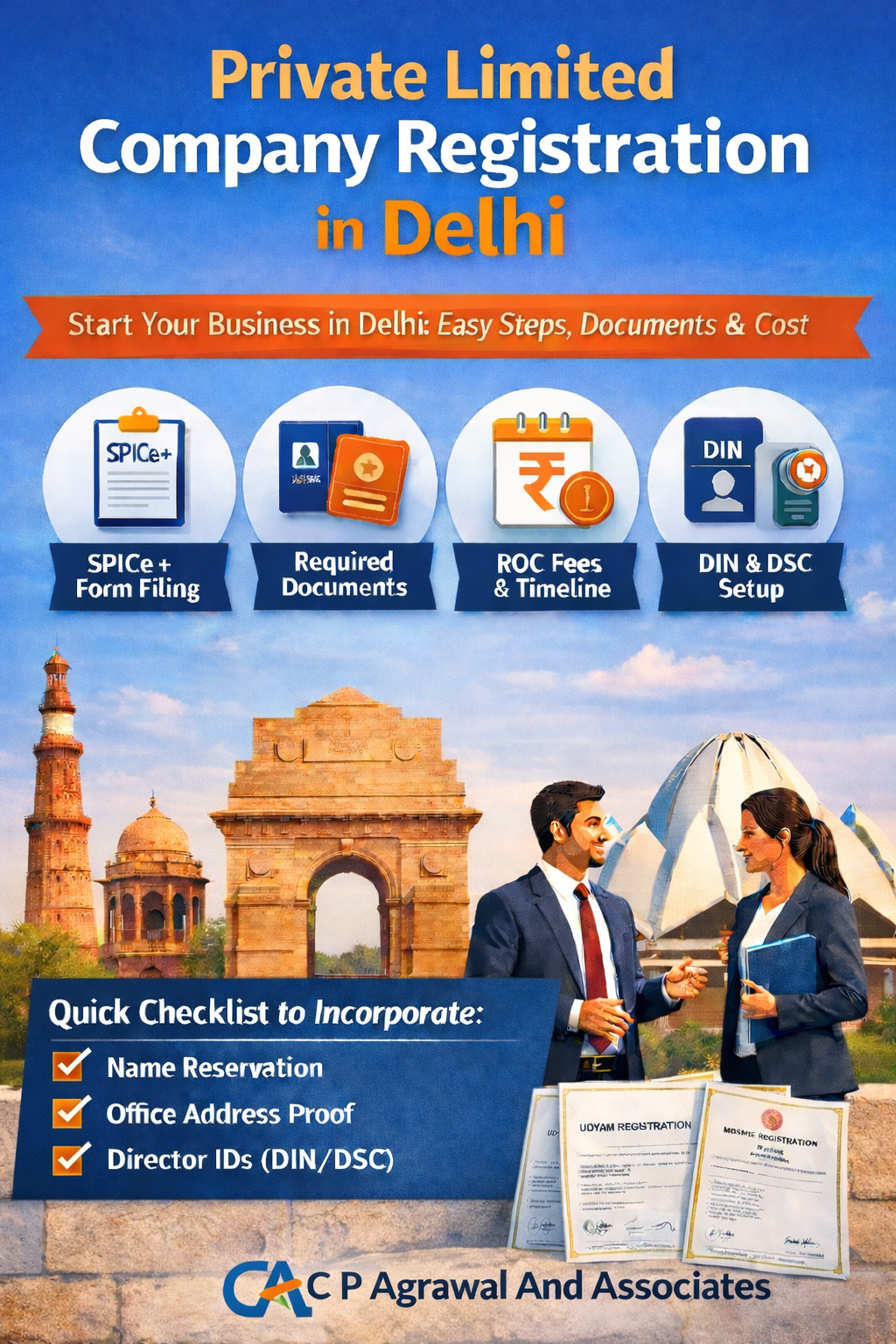

Step-by-step: How to register a Private Limited company online in Delhi (practical) 🛠️

-

Name reservation (Part A of SPICe+) — propose up to 2–3 name options; check for trademarks and take a sensible, brandable name.

-

Get Digital Signatures (DSC) for signing directors — the SPICe+ submission requires authorized signatories to sign electronically.

-

Fill SPICe+ (Part B) — this single integrated form handles incorporation, DIN application (if new), PAN & TAN application, and can also start GST/EPFO/ESIC/Bank account processes.

-

Attach mandatory documents — identity & address proofs of directors (Aadhaar/Passport/Driving Licence), passport-size photos, registered office proof (rental agreement + NOC or ownership documents + recent utility bill), subscriber/director declarations (INC-9 / DIR-2).

-

Pay government filing fees & stamp duty — government fee depends on authorised capital and state stamp duty (varies by state). Submit and track on the MCA portal.

-

ROC processing & incorporation certificate (COI) — once approved you’ll receive the Certificate of Incorporation and PAN/TAN (if applied through SPICe+). Typical timeline varies (usually a few days to 2–3 weeks depending on name approval & clarifications).

Typical documents you must keep ready (quick checklist) ✅

-

Aadhaar / Passport / Voter ID / Driving licence (directors & subscribers).

-

Passport-size photo of each director.

-

Proof of registered office: rent agreement + NOC (or ownership deed) + latest utility bill (not older than 2 months).

-

Bank statement or utility bill for address proof (if required).

-

PAN (if directors already have it) or details for PAN application via SPICe+.

-

Form DIR-2 (consent to act as director) and INC-9 (declaration by subscribers).

Where do you file in Delhi? ROC contact & practical note 📍

File on the MCA portal (SPICe+ web form). The Registrar of Companies for Delhi & Haryana is the local ROC office that handles post-incorporation matters (office address and contact are available on MCA/ROC listings). For Delhi, ROC office details (Nehru Place IFCI Tower) are commonly referenced for correspondence.

Typical fees & timeline (what to expect) 💸

-

Government / ROC fees & stamp duty: depend on authorised capital and state stamp schedules — can range widely.

-

Professional fees (CA / registration agent): commonly in the range of ₹5,000–₹20,000 depending on scope (basic filing vs. end-to-end service and complexity).

-

Turnaround time: name approval usually 1–7 business days; full incorporation often completed in a few days to 2–3 weeks if papers are complete and no queries raised.

Common reasons for rejections & delays — avoid these ⚠️

-

Name similarity to an existing company or trademark.

-

Mismatch between address proof and registered office proof (missing NOC).

-

Unsigned or incorrectly signed documents (missing DIR-2 / INC-9).

-

Incorrect DSC details or expired digital signatures.

-

Incomplete KYC / PAN mismatches.

Pre-registration checklist — do these now (easy wins) ✅

-

Reserve 2–3 suitable names and check trademark availability.

-

Arrange DSCs for the directors who will sign — don’t leave this for last.

-

Collect clean, recent utility bill / rent agreement + landlord NOC for the registered office.

-

Get Aadhaar / PAN / passport scans and passport photos ready (high-quality PDFs).

-

Decide authorised capital and shareholding percentages (simple cap table).

-

Draft short object clause (MOA) and initial AOA notes — keep it straightforward for startups.

-

Keep a dedicated email and mobile number for MCA / bank communication.

What to do immediately after incorporation (next 7–15 days) 🛎️

-

Open a current account in the company name (bank requires COI, PAN, board resolution).

-

Apply for GST (if turnover threshold or taxable activity) — SPICe+ can kickstart GST application but separate activation may be needed.

-

Register for EPFO/ESIC (if you’ll have employees) — SPICe+ provides links to these registrations during incorporation.

-

File Form INC-22 (intimation of registered office) / other ROC filings as required.

-

Set up basic bookkeeping & payroll — avoid gaps that cause compliance headaches later.

How C.P. Agrawal & Associates helps — practical, end-to-end support 🤝✨

We handle the entire incorporation journey for Delhi businesses with clear scope and fixed fees:

-

Pre-filing advisory & name strategy (prevent rejections)

-

Trademark + name-sensitivity check, advise on brandable names and backup names.

-

Help you decide between Pvt Ltd / LLP / OPC based on growth plan.

-

-

DSC & DIN handling (paperwork done for you)

-

Arrange DSCs for directors, prepare DIR-2 consent and apply for DINs where required.

-

-

Full SPICe+ filing (one-stop)

-

Complete Part A & B, attach MOA/AOA, subscriber details and PAN/TAN applications.

-

Track MCA portal status and respond to ROC queries promptly.

-

-

Registered office pack & NOC management

-

Prepare registered office documents, draft landlord NOC, and format utility bills so ROC accepts them without back-and-forth.

-

-

Post-incorporation support (bank & compliance starter pack)

-

Help open current account with required board resolution.

-

Handhold GST application, EPFO/ESIC links and first-year compliance calendar.

-

-

Fixed-fee packages & speed option

-

Standard package (complete filing + basic post-incorporation docs).

-

Express package (fast-track name approval & monitoring; ideal when you need to start contracts quickly).

-

-

Optional add-ons

-

Udyam/MSME registration, trademark filing, bookkeeping setup, payroll onboarding and monthly compliance subscription.

-

Why Delhi businesses trust us

-

Transparent pricing — fixed fees for standard scopes and clear add-ons for extra work.

-

CA-led support — all filings reviewed by qualified CAs who also set up your basic tax/compliance workflows.

Quick FAQs

Q: Can SPICe+ also apply for GST?

A: SPICe+ allows simultaneous initiation of GST, PAN & TAN applications, though GST activation may require separate follow-up.

Q: How long before I can sign client contracts?

A: After you receive the Certificate of Incorporation (COI) and PAN, you can legally sign contracts; bank account opening may take a few more days.

Q: Do foreign nationals / NRIs face extra steps?

A: Yes — additional identity/address proofs (passport, overseas address proof) and KYC validations are required for foreign directors.

Ready-to-start offer (CTA) 🚀

If you’re in Delhi and want a smooth incorporation without surprises:

Get a free 30-min consultation + a free incorporation checklist (PDF) — we’ll run a quick name check and give a firm quote.

🚗 Get Directions on Google Maps

📞 Call us now at +91 9311221571